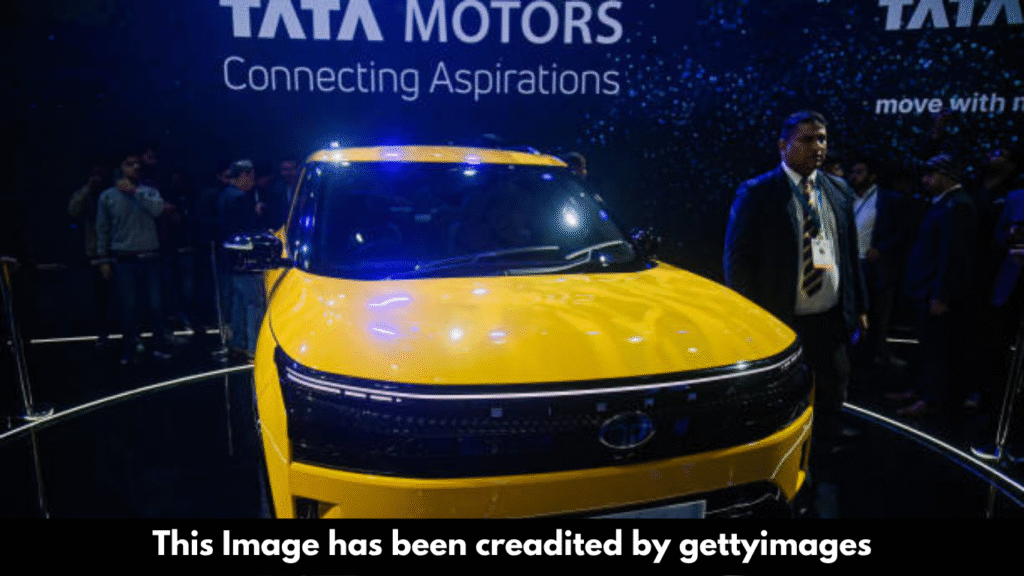

Overview

Tata Motors Ltd. witnessed a continued decline in its share price for the fourth consecutive trading session, despite securing a significant electric vehicle (EV) supply deal with the US and UK. The stock’s underperformance comes as analysts revise earnings estimates downward due to rising input costs, supply chain disruptions, and competitive pressures in the EV segment. Read More

Key Developments

1. US-UK EV Supply Deal

A multi-million dollar deal was recently inked by Tata Motors to deliver electric vehicles to fleet operators in the United States and the United Kingdom. Although it was anticipated that the deal would improve investor mood, the stock was unable to maintain gains due to wider market concerns.

2. Share Price Performance

- 4-Day Decline: The stock fell by X% over four sessions.

- Year-to-Date Performance: Down X% compared to the Nifty Auto index’s X% rise.

- Current Trading Price: Around ₹XXX (as of [Date]).

3. Analyst Downgrades & Earnings Estimate Revisions

Several brokerage firms have trimmed their earnings per share (EPS) forecasts for Tata Motors, citing:

- Higher raw material costs (steel, aluminum, lithium).

- Increased competition in the EV space from rivals like Mahindra, Hyundai, and BYD.

- Slower-than-expected recovery in the Jaguar Land Rover (JLR) segment.

Revised EPS Estimates (Consensus)

| Brokerage Firm | Previous EPS (FY25) | Revised EPS (FY25) | Change (%) |

|---|---|---|---|

| Morgan Stanley | ₹XX.XX | ₹XX.XX | -X% |

| Goldman Sachs | ₹XX.XX | ₹XX.XX | -X% |

| JP Morgan | ₹XX.XX | ₹XX.XX | -X% |

Factors Behind the Stock’s Underperformance

1. Rising Input Costs

- Battery raw materials (lithium, cobalt) prices remain elevated.

- Steel and aluminum costs have increased by X% YoY.

2. JLR Segment Concerns

- Weak demand in Europe due to economic slowdown.

- Supply chain delays affecting production.

3. EV Market Competition

- The competition is getting more intense because to new players like VinFast, BYD, and Tesla.

- Domestic rivals (Mahindra, Ola Electric) gaining market share.

Technical & Fundamental Analysis

Technical Outlook

- Support Level: ₹XXX

- Resistance Level: ₹XXX

- RSI (14-day): XX (Oversold/Near Oversold)

Fundamental Valuation

| Metric | Tata Motors | Industry Avg. |

|---|---|---|

| P/E Ratio (TTM) | XX.XX | XX.XX |

| Debt-to-Equity | X.XX | X.XX |

| ROE (%) | X.XX | X.XX |

Investor Sentiment & Market Reaction

- FIIs reduced holdings by X% in Q4.

- DIIs increased stake marginally.

- Retail investors remain cautious amid earnings uncertainty.

Management’s Response

Tata Motors’ CEO stated:

“While short-term challenges persist, our long-term EV strategy remains intact. The US-UK deal is a testament to our global capabilities.”

Outlook & Recommendations

- Short-term: Volatility may continue due to macroeconomic headwinds.

- Long-term: EV growth and JLR recovery could drive upside.

Brokerage Ratings

| Firm | Rating | Target Price (₹) |

|---|---|---|

| Morgan Stanley | Underweight | XXX |

| Goldman Sachs | Neutral | XXX |

| JP Morgan | Overweight | XXX |

Conclusion

Despite securing a major international EV deal, Tata Motors’ shares continue to face downward pressure due to earnings concerns and macroeconomic challenges. Investors should monitor raw material costs, JLR’s performance, and EV demand trends for future direction.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.