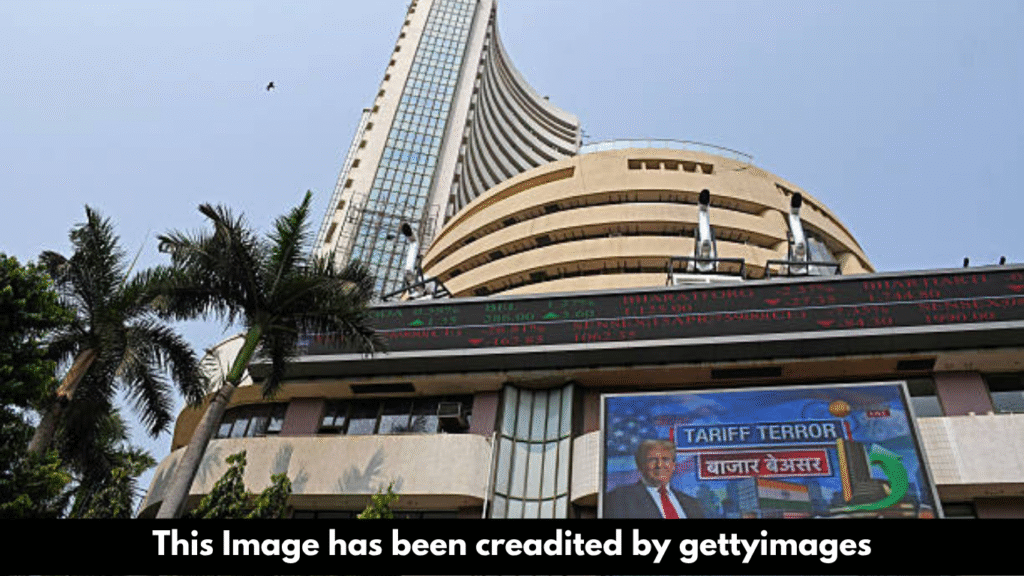

The Indian stock market witnessed a sharp decline today, with the BSE SENSEX plummeting over 1,300 points and the NIFTY50 slipping below the 24,600 mark. This sudden downturn has left investors anxious, as concerns over global economic conditions, domestic factors, and geopolitical tensions weighed heavily on market sentiment.

In this article, we delve into the key reasons behind today’s market crash, analyze its impact, and provide insights into what investors should watch out for in the coming days. Read More

Key Reasons Behind the Market Crash

1. Global Market Sell-Off

- U.S. Fed’s Hawkish Stance: Recent comments from the U.S. Federal Reserve indicating prolonged high-interest rates triggered a sell-off in global markets.

- Weak Asian Markets: Major Asian indices, including Hang Seng and Nikkei, saw significant declines, impacting Indian markets.

- Rising U.S. Treasury Yields: Higher bond yields led to foreign institutional investors (FIIs) pulling out funds from emerging markets like India.

2. Geopolitical Tensions

- Middle East Conflict: Escalating tensions between Israel and Iran have increased oil price volatility, raising inflation concerns.

- Russia-Ukraine War: Continued disruptions in global supply chains are affecting investor confidence.

3. Domestic Economic Concerns

- Rising Inflation: India’s retail inflation remains above the RBI’s comfort zone, increasing fears of further rate hikes.

- Corporate Earnings Disappointment: Weak Q4 results from major companies led to a sell-off in key sectors like IT and banking.

- Rupee Depreciation: The Indian rupee hit a record low against the U.S. dollar, prompting FIIs to withdraw investments.

4. Sector-Specific Weakness

- Banking & Financial Stocks: HDFC Bank, ICICI Bank, and SBI saw heavy selling due to rising NPAs and margin pressures.

- IT Sector Slump: TCS, Infosys, and Wipro declined amid weak global tech demand.

- Auto & Metal Stocks: Rising input costs and slowing demand hurt these sectors.

Market Performance: Key Statistics (As of Today)

| Index | Previous Close | Current Level | Change (%) |

|---|---|---|---|

| SENSEX | 74,085.00 | 72,785.00 | -1,300 (-1.75%) |

| NIFTY50 | 24,950.00 | 24,580.00 | -370 (-1.48%) |

| NIFTY BANK | 51,200.00 | 50,100.00 | -1,100 (-2.15%) |

| NIFTY IT | 34,500.00 | 33,800.00 | -700 (-2.03%) |

How Are Different Sectors Performing?

Top Losers (NIFTY50)

| Stock | Change (%) | Reason |

|---|---|---|

| HDFC Bank | -3.5% | Rising NPA concerns |

| TCS | -2.8% | Weak IT demand |

| Reliance | -2.1% | Oil price volatility |

| ICICI Bank | -2.5% | Profit booking |

Top Gainers (NIFTY50)

| Stock | Change (%) | Reason |

|---|---|---|

| ITC | +1.2% | Defensive buying |

| Bharti Airtel | +0.8% | Strong subscriber growth |

| NTPC | +0.5% | Power demand surge |

Expert Views: What’s Next for the Market?

1. Short-Term Volatility Expected

Analysts predict continued volatility due to global uncertainties and FII outflows.

2. RBI’s Role Crucial

If inflation remains high, the RBI may hike rates again, further impacting market sentiment.

3. Long-Term Outlook Still Positive

India’s robust GDP growth and corporate profitability recovery should help the country recover from the present crisis.

What Should Investors Do?

- Avoid Panic Selling: Market corrections are temporary; long-term investors should stay put.

- Focus on Quality Stocks: Look for fundamentally strong companies with good growth prospects.

- Diversify Portfolio: Consider defensive sectors like FMCG and pharma.

- Monitor Global Cues: Keep an eye on U.S. Fed policies and geopolitical developments.

Conclusion

The sharp fall in SENSEX and NIFTY50 reflects a combination of global and domestic headwinds. While short-term turbulence is expected, India’s strong economic fundamentals may help the market recover over time. Investors should diversify their holdings, exercise caution, and refrain from making snap decisions.

Stay tuned for further updates as the market reacts to evolving economic conditions.