Introduction

In India, digital payments have been transformed by the Unified Payments Interface (UPI), which makes transactions quick and easy. The National Payments Corporation of India (NPCI) has made a significant announcement: beginning on June 16, UPI transactions would be much faster. Millions of customers on well-known platforms like PhonePe, Google Pay, and Paytm will gain from this improvement, which guarantees faster processing and more dependability. Read More

This article explores the upcoming changes, their benefits, and how they will impact users. We also provide a detailed feature comparison table and an analysis sheet for better understanding.

Why Are UPI Transactions Getting Faster?

The NPCI has been continuously working on upgrading the UPI infrastructure to handle the increasing transaction volume. With over 10 billion UPI transactions per month, the system requires optimizations to reduce delays and failures.

Key Improvements from June 16:

- Reduced Processing Time – Transactions will be completed in under 2 seconds.

- Enhanced Success Rate – Fewer failed transactions due to backend optimizations.

- Multi-Bank Processing – Better load balancing across banks to prevent downtime.

- AI-Based Fraud Detection – Real-time fraud checks without slowing down payments.

What Effect Will This Have on Users of Paytm, Google Pay, and PhonePe?

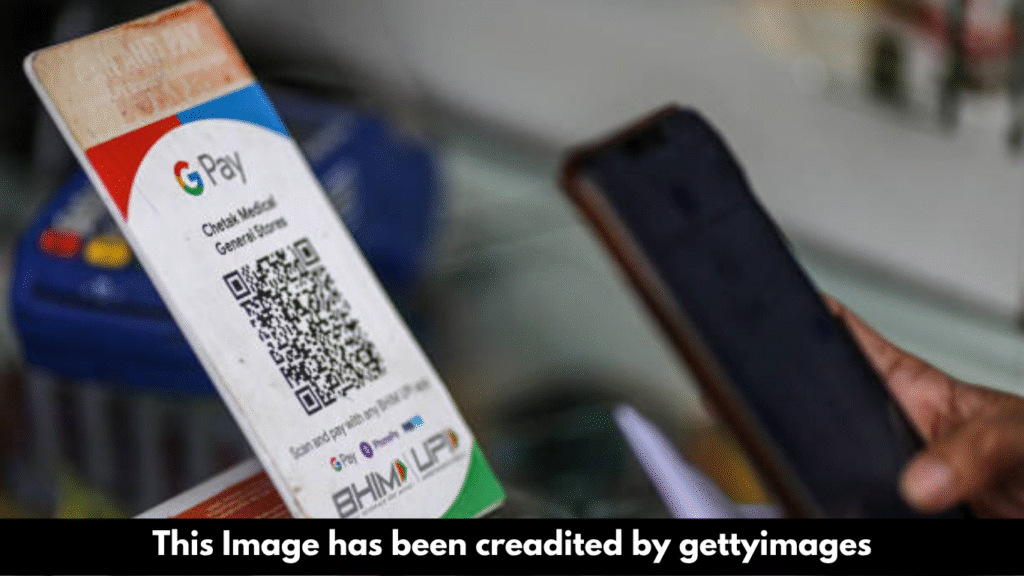

Popular UPI apps like PhonePe, Google Pay, and Paytm will integrate these upgrades, ensuring a smoother experience for users.

Expected Benefits:

✅ Quicker online checkout processes (Amazon, Flipkart, Swiggy, Zomato).

✅ Instant peer-to-peer (P2P) transfers without delays.

✅ Fewer transaction declines during peak hours.

✅ Better merchant payments at shops and vendors.

Feature Comparison: UPI Before & After June 16 Upgrade

| Feature | Before June 16 | After June 16 |

|---|---|---|

| Transaction Speed | 3-5 seconds | Under 2 seconds |

| Success Rate | ~98% | ~99.5% |

| Peak Hour Stability | Occasional failures | More reliable |

| Fraud Detection | Basic checks | AI-powered scanning |

| Bank Processing | Single-bank reliance | Multi-bank routing |

Detailed Analysis of the UPI Upgrade

1. Technical Enhancements

The NPCI is implementing UPI 2.0+, which includes:

- Advanced server clusters to handle higher loads.

- Dynamic routing to avoid bank server congestion.

- Real-time monitoring to detect and resolve issues instantly.

2. Impact on Businesses & Merchants

- Faster settlements for UPI QR code payments.

- Reduced payment failures during high-traffic events (sales, festivals).

- Better cash flow management due to instant credit.

3. Security Upgrades

- Biometric authentication for high-value transactions.

- One-time password (OTP) enhancements to prevent phishing.

- End-to-end encryption for all UPI transactions.

What Users Need to Do?

Most changes will be automatic, but users should:

✔ Update to the most recent version of their UPI apps (PhonePe, Google Pay, and Paytm).

✔ Enable biometric authentication for added security.

✔ Check transaction history regularly for discrepancies.

Conclusion

An important development in India’s digital payment ecosystem is the June 16 UPI upgrade. Customers of PhonePe, Google Pay, and Paytm will have a more seamless and effective payment experience thanks to quicker processing, greater success rates, and improved security.

Stay tuned for more updates, and ensure your apps are updated to leverage these improvements!

FAQs

Q1. Will the UPI upgrade affect transaction limits?

No, the existing limits (₹1 lakh per transaction for most banks) remain unchanged.

Q2. Do I need to switch to a different UPI app?

No, all major apps will support the upgrade automatically.

Q3. Will failed transactions be refunded faster?

Yes, refunds for failed UPI payments will be processed within 15 minutes.

Q4. Are there any charges for faster UPI transactions?

No, UPI is still free for merchant and peer-to-peer transactions.